The cryptocurrency world is full of innovations, but very few blockchains manage to achieve speed, scalability, and cost-effectiveness simultaneously. Solana is one of those rare platforms. Known for its fast transactions and low fees, Solana has quickly become a favorite among developers, traders, and investors. It processes a massive number of transactions very quickly and cheaply. It positions itself as a solution to the scalability problems of networks like Ethereum and Bitcoin. In this blog, we will explore Solana, its history, how it works, and why it matters for the future of blockchain.

What is Solana?

Solana is a high-performance blockchain designed for decentralized applications (dApps) and crypto transactions. Unlike many other blockchains that face issues with slow speeds and high fees, Solana can process thousands of transactions per second. Its native cryptocurrency is called SOL, which powers the network, pays transaction fees, and is used for staking.

Solana aims to provide the foundation for scalable, secure, and user-friendly blockchain applications. From DeFi to NFTs, it supports a wide range of use cases without slowing down the network.

History and Founders

Solana was founded in 2017 by Anatoly Yakovenko, a former engineer at Qualcomm. Yakovenko, along with co-founder Greg Fitzgerald, wants to solve one of the biggest challenges in blockchain: scalability without compromising security or decentralization.

In 2020, Solana officially launched its mainnet. The project gained early support from venture capital firms and quickly grew as developers began using it for building decentralized finance (DeFi) applications, NFT marketplaces, and gaming platforms.

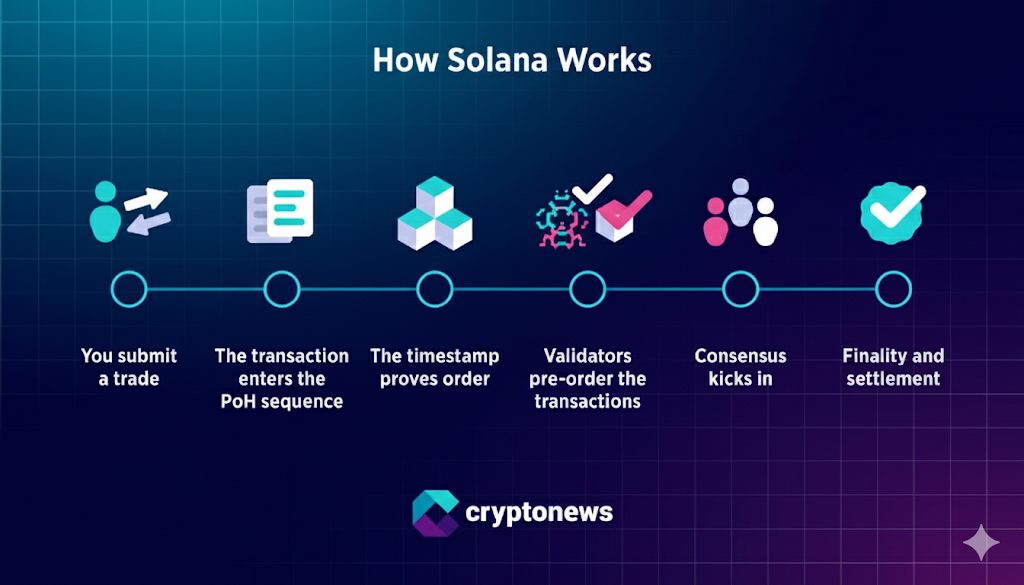

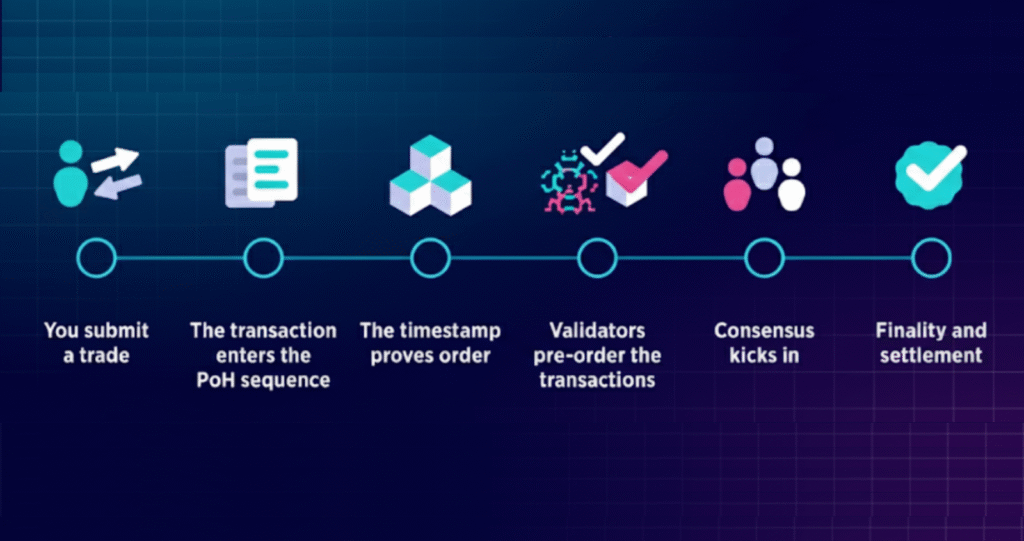

How Solana Works (Proof of History + Proof of Stake)?

The key innovation behind Solana is its Proof of History (PoH) mechanism, combined with Proof of Stake (PoS).

- Proof of History (PoH): This is like a cryptographic clock. It records events in the network with timestamps, which helps nodes agree on the order of transactions faster. This drastically reduces delays and boosts transaction speed.

- Proof of Stake (PoS): Validators secure the network by staking SOL tokens. They confirm transactions, create new blocks, and keep the blockchain safe.

Together, PoH and PoS allow Solana to process over 65,000 transactions per second, making it one of the fastest blockchains in the world.

Use Cases and Applications of Solana

Solana is more than just a blockchain. It supports a variety of applications across industries:

- Decentralized Finance (DeFi): Platforms like Serum and Raydium offer fast trading and lending solutions on Solana.

- NFT Marketplaces: Projects like Magic Eden and Solanart allow users to create, buy, and sell NFTs.

- Web3 Gaming: Solana powers blockchain games with smooth user experiences, thanks to its low transaction costs.

- Payments: Solana Pay enables instant, secure, and fee-friendly payments for businesses and individuals.

- Enterprise Use: Businesses use Solana for supply chain tracking, digital identity, and secure data transfers.

Advantages of Solana

- High Speed: Capable of processing more than 65,000 transactions per second.

- Low Fees: Average transaction cost is less than $0.01.

- Scalability: Designed to handle global adoption without network congestion.

- Developer-Friendly: Strong ecosystem for developers with easy-to-use tools.

- Growing Adoption: Many DeFi, NFT, and gaming projects are moving to Solana.

Challenges of Solana

- Network Outages: Solana sometimes faces downtime issues.

- Competition: Faces tough competition from Ethereum, Avalanche, and Polkadot.

- Decentralization Concerns: Some critics argue that Solana has fewer validators compared to Ethereum, raising centralization risks.

How to Invest in SOL?

Investing in Solana is straightforward. Here are the steps:

- Choose an Exchange: Buy SOL on exchanges like Binance, Coinbase, or Kraken.

- Create a Wallet: Use wallets like Phantom or Solflare for secure storage.

- Store Safely: Consider hardware wallets such as Ledger for long-term safety.

- Stake SOL: Earn passive rewards by staking SOL with trusted validators.

Note: Always do your research before investing, and never invest more than you can afford to lose.

Solana Profit Calculator

Investors often want to know how much profit they can make with Solana (SOL). A profit calculator is a simple tool that helps you estimate potential returns based on your investment amount, buying price, and selling price.

How does it work?

- Enter the investment amount

- Enter the buy price of SOL

- Enter the sell price of SOL

- The formula below shows your profit or loss

Formula:

Profit/Loss = (Selling Price − Buying Price) × Number of SOL Coins Profit

Example:

- Buy 10 SOL at $20 each = $200 investment

- Sell 10 SOL at $30 each = $300 return

- Profit = $100

Introduction to DeFi on Solana

Solana DeFi uses smart contracts to provide financial services without banks or middlemen. In traditional finance, banks control your money, set rates, and limit access. In DeFi, you control your assets, rates are market-driven, and services are open to anyone, anytime.

- Start Small – Use amounts you can afford to lose.

- Try Simple Swaps – Connect your wallet and try token swaps on a DEX.

- Explore Lending – Research platforms and begin with stable assets.

- Learn Liquidity – Understand impermanent loss and track returns carefully.

Staying Safe in DeFi

- Research protocols (audits, team, track record)

- Diversify investments

- Monitor your positions regularly

- Avoid red flags like guaranteed returns or anonymous teams

Solana vs Ethereum

| Feature | Solana (SOL) | Ethereum (ETH) |

| Consensus Mechanism | Proof of History (PoH) + Proof of Stake (PoS) | Proof of Stake (PoS) |

| Transaction Speed | Up to 65,000+ TPS | 30–45 TPS |

| Transaction Fees | Extremely low (< $0.01) | Higher, $1–$50 depending on congestion |

| Scalability | High scalability with PoH | Relies on Layer-2 scaling solutions |

| Ecosystem | Fast-growing in DeFi, NFTs, and gaming | Largest Solana DeFi and NFT ecosystem |

| Network Stability | Some outages in the past | Highly reliable and secure |

| Development Tools | Rust, C, and C++ | Solidity (widely adopted) |

| Decentralization | Fewer validators | More decentralized, thousands of validators |

Which is better, Ethereum or Solana?

- Ethereum is more established and secure, making it a strong long-term choice.

- Solana is faster and cheaper, attracting new projects and users.

Future Potential of Solana

Solana’s future looks promising as it continues to expand its ecosystem. The blockchain is expected to attract more developers, projects, and enterprises in the coming years.

Key growth areas include:

- Web3 Adoption: Supporting decentralized internet applications.

- Global Payments: Expanding Solana Pay for real-world businesses.

- Institutional Interest: More investment firms are exploring Solana for DeFi and NFTs.

- Innovation in Scalability: Continuous upgrades to reduce outages and improve stability.

If Solana maintains its pace of innovation, it could become a dominant force in the blockchain space.

Solana (SOL) Prediction

Based on technical analysis, the projected prices for SOL are as follows:

| Category | Projected Price (USD) |

| Projected High | $272.00 – $300.00 |

| Average Price | $130.32 – $235.00 |

| Projected Low | $50.00 – $197.00 |

| Major Resistance Zone | $189.13 – $260.00 |

| Major Support Zone | $78.14 – $125.00 |

Solana (SOL) remains a dominant force in the Layer-1 sector due to its high-speed performance. Currently, the 2026 outlook hinges on the full implementation of the Firedancer validator client. This upgrade significantly improves network stability and aims for a throughput exceeding 100,000 transactions per second. Furthermore, the ecosystem sees heavy expansion in DePIN and AI-agent economies, attracting massive institutional inflows. While the market faces potential macro corrections, Solana’s leading position in decentralized finance and NFTs provides a strong foundation. Consequently, most analysts expect new all-time highs as the network establishes itself as a global finance hub.

Conclusion

Solana is not just another blockchain. It is a powerful platform that combines speed, scalability, and low costs to deliver real-world applications. From DeFi and NFTs to gaming and payments, Solana’s ecosystem is growing rapidly. For investors, SOL offers both opportunities and risks. While challenges like network outages remain, the potential for long-term growth is significant. As blockchain adoption rises globally, Solana stands out as one of the most promising projects in the crypto industry.

Disclaimer:

This content is created for educational purposes only and does not represent financial or investment advice. Investing in cryptocurrency involves significant risks, including possible loss of capital. Make sure to research carefully and consult with a qualified financial advisor before investing. While we aim to provide accurate and updated information, we do not take responsibility for any errors, omissions, or investment losses.

FAQs

What exactly is the Firedancer upgrade?

Firedancer is a high-performance validator client that drastically boosts Solana’s speed and network reliability.

How does Solana achieve such high speeds?

The protocol combines a unique Proof of History mechanism with a fast Tower BFT consensus.

What is the primary role of the SOL token?

Users use SOL to pay for transaction fees, participate in governance, and secure the network through staking.

Is Solana DeFi better than Ethereum DeFi?

Solana DeFi offers significantly lower fees and faster finality, making it highly competitive for active retail trading.

What are the major risks in 2026?

Investors must monitor network outages, heavy competition from other Layer-1s, and potential global regulatory shifts.

Can I earn passive income with SOL?

Yes, staking SOL currently offers between 5% and 7% APY while supporting overall network security.

What is the impact of Solana ETFs?

Spot ETFs drive significant institutional capital into the network, often signaling strong long-term confidence from large investors.

How does Sol handle scalability?

The architecture uses a sharding-free, multi-threaded design that maximizes hardware efficiency to process thousands of transactions per second.

What is the 2026 target for network finality?

The upcoming Alpenglow consensus aims to achieve transaction finality in under 150 milliseconds for real-time applications.

Where should I store my SOL safely?

Long-term holders typically use hardware wallets like Ledger or official non-custodial wallets like Phantom for security.