The Next-Gen Blockchain for Speed and Scalability

The blockchain industry has evolved rapidly, moving beyond Bitcoin and Ethereum to faster and more scalable networks. Among these new players, Avalanche (AVAX) has emerged as one of the strongest contenders. With its unique design, eco-friendly approach, and strong developer ecosystem, Avalanche is attracting attention from both enterprises and retail investors.

Let’s explore what makes Avalanche special, its use cases, and how it stands against other leading blockchains.

What is Avalanche (AVAX)?

Avalanche is a smart contract platform designed to be fast, low-cost, and eco-friendly. Unlike Ethereum, which often struggles with congestion and high fees, Avalanche uses a unique consensus mechanism that allows it to process thousands of transactions per second with near-instant finality.

Its native token, AVAX, powers the network by being used for fees, staking, and governance. Avalanche aims to create a blockchain network that is both scalable and decentralized, making it ideal for decentralized finance (DeFi), non-fungible tokens (NFTs), and enterprise solutions.

History and Founders

Ava Labs, a blockchain company founded in 2018 by Cornell professor Emin Gün Sirer, developed Avalanche. Emin brings deep expertise in distributed systems and cryptocurrencies to the project.

The project officially launched in September 2020, following a successful public token sale. Since then, Avalanche has become one of the top blockchain platforms by Total Value Locked (TVL) in DeFi protocols, attracting major partnerships with projects across finance, gaming, and NFTs.

How Avalanche Works

Avalanche introduces a novel consensus protocol that allows thousands of validators to confirm transactions quickly and efficiently. The network is structured into three interoperable blockchains, each with its own purpose:

- Exchange Chain (X-Chain): Used for creating and trading digital assets.

- Contract Chain (C-Chain): Runs smart contracts compatible with Ethereum’s Solidity language.

- Platform Chain (P-Chain): Manages validators, staking, and network governance.

This multi-chain architecture gives Avalanche flexibility and scalability, separating different functions while keeping the system secure. Transactions on Avalanche achieve finality in under two seconds, making it one of the fastest platforms available.

Use Cases of Avalanche

Avalanche is not just about speed; it powers a wide range of applications, including:

- DeFi (Decentralized Finance): Protocols like Trader Joe and Benqi run on Avalanche, offering lending, trading, and yield farming.

- NFTs and Gaming: Avalanche supports NFT marketplaces and play-to-earn games that need fast, low-cost transactions.

- Enterprise Solutions: Businesses use Avalanche for tokenization of assets and building private blockchain networks.

- Cross-Chain Bridges: The Avalanche Bridge allows assets to move easily between Avalanche and Ethereum, encouraging liquidity sharing.

Advantages of Avalanche

- High Scalability: For a blockchain to be used for global finance or popular applications, it must be able to handle demand. Bitcoin (~7 TPS) and Ethereum (~15-30 TPS) can become congested, leading to slow times and high fees. Avalanche’s high throughput means it can support many users and complex applications smoothly.

- Low Fees: High fees (like the $50+ fees seen on Ethereum during peak times) make it impractical for small transactions and discourage users. Low fees make everyday use—like micro-transactions, gaming, and DeFi interactions—economically feasible for everyone.

- Eco-Friendly: In PoS, validators secure the network by “staking” (locking up) their coins, not by running powerful computers 24/7. This reduces Avalanche’s energy consumption to a tiny fraction of Bitcoin’s, addressing a major environmental criticism of blockchain technology.

- Ethereum Compatibility: This is a huge advantage for attracting developers. It means that any application built on Ethereum (like Uniswap or Aave) can be easily copied and deployed on Avalanche with minimal changes. This gives Avalanche instant access to the vast ecosystem of Ethereum developers and projects, who can enjoy Avalanche’s higher speed and lower fees without learning a new programming language.

- Interoperable Subnets: Interoperable Subnets are like allowing large companies or communities to build their own private, custom-designed districts within the city that have their own rules but are still connected to all its main roads and utilities.

Challenges Avalanche Faces

While Avalanche has strong features, it faces challenges too:

- Competition: Solana, Cardano, and Polkadot also target high-speed blockchain adoption.

- Adoption Curve: Ethereum still dominates developer activity and user base.

- Network Congestion Risks: Although rare, heavy demand could test Avalanche’s scalability in the future.

Investing in AVAX

You can invest in Avalanche by purchasing AVAX tokens through popular exchanges like Binance, Coinbase, and Kraken. Investors can also stake AVAX to earn rewards and participate in governance.

Before investing, it’s important to research thoroughly, understand market volatility, and consider long-term adoption trends.

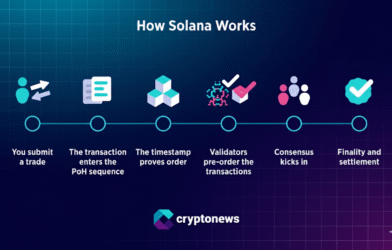

Avalanche (AVAX) vs Solana (SOL)

Avalanche and Solana are often compared since both promise fast, low-cost transactions. However, their approaches differ significantly.

| Feature | Avalanche (AVAX) | Solana (SOL) |

| Consensus Mechanism | Avalanche Consensus + Snow Protocol | Proof-of-History + Proof-of-Stake |

| Transaction Finality | Under 2 seconds | Around 13 seconds |

| TPS (Transactions per Second) | 4,500+ (scalable with subnets) | 3,000–5,000 (theoretical max 65,000) |

| Architecture | Three-chain system (X, C, P) | Single-chain with Proof-of-History |

| Energy Efficiency | Extremely eco-friendly | More efficient than Ethereum, but less green than Avalanche |

| Use Cases | DeFi, subnets, enterprise blockchain | DeFi, NFTs, gaming |

| Developer Focus | Ethereum-compatible, subnet flexibility | Strong NFT and Web3 developer adoption |

Quick Analysis: Avalanche is ideal for custom blockchains and enterprise adoption, while Solana shines in NFTs, DeFi, and dApps.

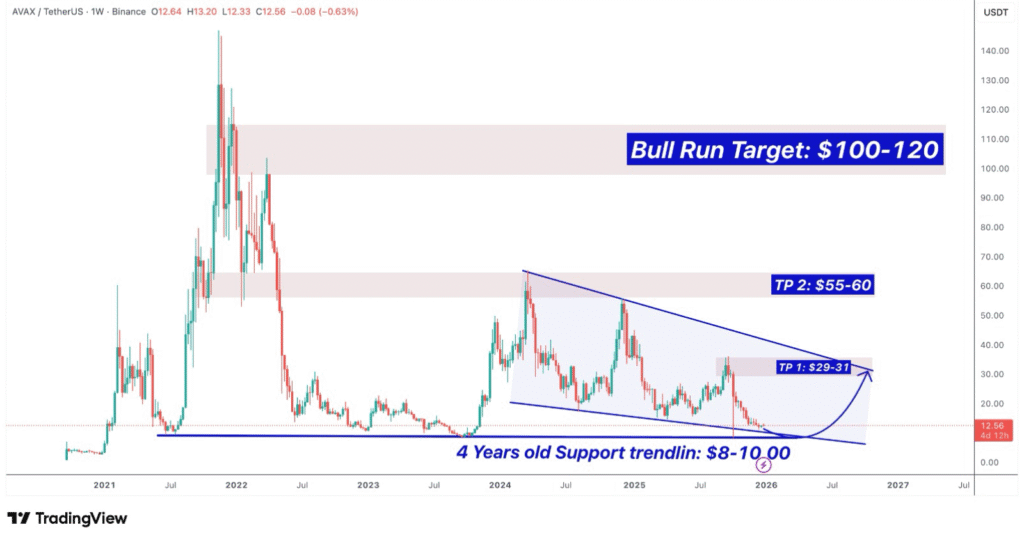

Avalanche Price Prediction

| Category | Projected Price |

| Projected High | $26.38 – $100.00 |

| Average Price | $20.13 – $65.50 |

| Projected Low | $8.50 – $38.60 |

| Major Resistance Zone | $34.31 – $46.53 |

| Major Support Zone | **$10.00 – $13.24** |

Avalanche (AVAX) functions as a high-speed Layer-1 blockchain that utilizes a unique three-chain architecture to maximize throughput and scalability. Furthermore, major financial institutions like JPMorgan and Citi continue to utilize Avalanche subnets for tokenizing real-world assets (RWAs). Strategic catalysts, such as the potential approval of a spot AVAX ETF and a Nasdaq listing for Avalanche Treasury Co., aim to drive massive institutional capital into the ecosystem.

With a focus on speed, scalability, and eco-friendliness, Avalanche is positioning itself as a major player in the next generation of blockchain technology.

Disclaimer

This blog is for educational purposes only and does not provide financial advice. Cryptocurrency markets are highly volatile, and you should always do your own research before investing.

Frequently Asked Questions

What is the Avalanche blockchain designed for?

The Avalanche blockchain is built for high scalability, fast finality, and customizable networks using subnets.

How does Avalanche achieve high transaction speed?

Avalanche uses a unique consensus mechanism that enables near-instant finality and high throughput.

What is AVAX coin used for in the ecosystem?

AVAX coin is used for transaction fees, staking, governance participation, and securing the network.

How secure is the Avalanche blockchain?

It offers strong security through its probabilistic consensus and decentralized validator network.

What factors influence Avalanche AVAX price?

AVAX price depends on network usage, staking demand, ecosystem growth, and overall crypto market trends.

Who is building on Avalanche today?

DeFi platforms, gaming projects, enterprises, and institutional applications actively build on Avalanche.

How does Avalanche support custom blockchains?

It allows developers to launch application-specific subnets with their own rules and validators.

What is Avalanche’s operational uptime?

The Avalanche network maintains high uptime due to its efficient architecture and validator performance.

How does staking work for AVAX coin?

Users can stake AVAX coin with validators to earn rewards while helping secure the network.

How does Avalanche compare to other Layer-1 blockchains?

It focuses on speed, flexibility, and scalability, while many Layer-1 blockchains prioritize general-purpose smart contracts.