Imagine a global computer that never sleeps, open to anyone, anywhere, and ready to run your ideas instantly. That’s the vision behind Ethereum, and it’s more exciting than ever. Since its launch in 2015 by Vitalik Buterin and a small team of co-founders, Ethereum has grown far beyond being “just another cryptocurrency.” It has become the bedrock of the Web3 ecosystem, powering decentralized apps (dApps), non-fungible tokens (NFTs), stablecoins, gaming, and much more.

In this article, we’ll see what Ethereum really is, why it matters, how it works, and what the future may hold for you as a user, developer, or investor.

What is Ethereum?

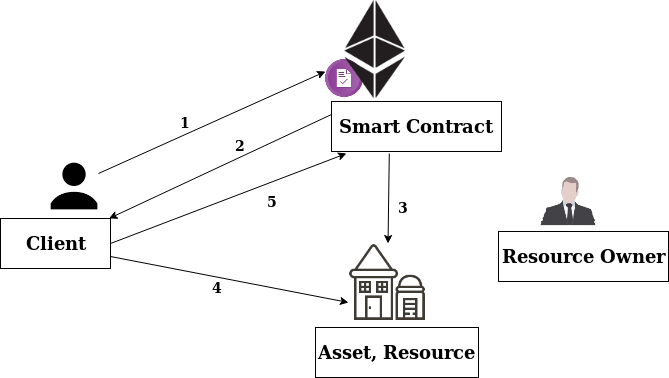

Ethereum is an open, public blockchain that launched in July 2015. While the original blockchain, Bitcoin, focused on peer-to-peer value transfer (digital cash), Ethereum took the next leap: smart contracts. These are computer-programmed contracts that automatically execute when certain conditions are met; no lawyer, no bank, just transparent code.

With smart contracts, Ethereum enables the creation of dApps (decentralised applications) that run 24/7, globally, and anyone with an internet connection can participate. From global finance (DeFi) to digital art (NFTs) to games and social media, all of it lives on the Ethereum platform.

Its native token, Ether (ETH), powers the whole ecosystem. Every transaction, every smart contract execution, requires ETH. So Ethereum is much more than “just a coin” ,it’s the fuel of a programmable internet.

What is Ether (ETH)?

Ether (ETH) is the lifeblood of the Ethereum network. You can send it across the world in seconds, stake it, use it to build applications, and pay for it when you use the network.

Here are some of the key roles of ETH:

- Fees (Gas): Every time you send tokens, mint an NFT, or interact with a dApp on Ethereum, you pay a small fee in ETH. That fee goes to the validators who secure the network.

- Staking & Network Security: Validators lock up (stake) ETH to operate nodes and process transactions. In return, they earn ETH rewards. This staking model gives Ethereum a self-sustaining economy driven by participants, not corporations.

- Scarcity / Deflationary pressure: Thanks to mechanisms like fee burning (a portion of each transaction fee is permanently removed), ETH can become deflationary, meaning more is burned than created on busy days. That adds a long-term value dimension.

- Digital Ownership & Innovation: ETH stands at the intersection of finance, technology and ownership. Holding ETH is more than holding a token; it’s owning part of the infrastructure of the future.

How Does Ethereum Work?

Smart Contracts

Smart contracts are lines of code written in Ethereum’s native language, Solidity, that execute when preset conditions are met. Instead of trusting a bank or intermediary, two parties trust the code itself. Smart contracts are key to the explosion of DeFi, NFTs, token launches, and more.

Consensus Mechanism: Proof of Stake

In September 2022, Ethereum completed its landmark transition from Proof of Work (PoW) to Proof of Stake (PoS): the famous “Merge”. This change made the network far more energy-efficient and opened the door to future scalability upgrades.

Under PoS:

- Validators stake ETH (minimum of 32 ETH for solo participation) to join the network.

- Blocks are proposed/validated based on the stake and other criteria (instead of brute-force mining).

- The network consumes far less power and is more sustainable.

dApps, NFTs & ERC-20 Tokens

Ethereum is home to countless decentralised applications (dApps) for finance, games, social platforms, art, collectibles, and more. On top of that:

- ERC-20 tokens: These are standard token types built on Ethereum. Many new crypto projects launch ERC-20 tokens, and they integrate seamlessly with wallets and exchanges thanks to the standard.

- NFTs (Non-Fungible Tokens): Unique digital assets, art, game items, and real-world assets live on Ethereum, making ownership and transfer transparent and secure.

- Layer 1 & Layer 2 ecosystem: Ethereum is the “Layer 1” underlayer. Layer 2 solutions (like roll-ups) build on top to boost speed and reduce costs, while inheriting Ethereum’s security.

Why Does Ethereum Matter?

A New Internet: Web3

Ethereum has been central to the emergence of Web3, the next chapter of the internet centered on ownership, decentralisation, and open participation. Its ecosystem spans DeFi (decentralised finance), NFTs, gaming, tokenised real-world assets, digital identity, and more.

Network Effects & Platform Power

With so much innovation happening on top of Ethereum, it benefits from strong network effects: developers build, users participate, projects launch, all reinforcing each other. That makes it harder for competitors to topple it quickly.

Flexible Use Cases

Ethereum’s design allows it to serve many different purposes:

- For individuals: transacting globally, collecting NFTs, interacting with dApps.

- For developers: launching smart contracts, building dApps, experimenting.

- For enterprises: tokenising assets, executing global payments, and loyalty programs.

Example: In 2025, platforms like Shopify (on the Base network launched on Ethereum) enable consumers to spend stablecoins with millions of merchants globally.

Growing Institutional Adoption & Price Momentum

Ether has broken its previous all-time high in 2025, and institutional interest is surging. For example, major banks raised their ETH year-end forecasts, signaling confidence in Ethereum’s utility and growth.

Ethereum vs. Bitcoin

- Purpose: Bitcoin = store of value / digital gold; Ethereum = programmable blockchain + smart contracts.

- Functionality: Ethereum allows dApps, NFTs, and tokens; Bitcoin largely only value transfer.

- Architecture: Ethereum’s upgrade path (PoS, sharding, roll-ups) is more ambitious in scale and complexity.

- Dynamics: Both have value, but Ethereum arguably offers more utility and innovation potential.

How to Get Started with Ethereum

Individuals (Users)

- Download a wallet, for example: MetaMask, Rainbow, or Coinbase Wallet.

- Buy a small amount of ETH via an exchange or directly inside your wallet.

- Explore dApps: Use ETH to send tokens, mint NFTs, try decentralised exchanges (Uniswap) or other apps.

- Stay safe: Ensure you save backup phrases, enable security features, and avoid phishing.

Developers

- Study the developer docs (Solidity, Ethers.js, Hardhat, Foundry).

- Experiment on testnets (like Sepolia) before going live.

- Use the open-source ecosystem; everything on Ethereum is composable, remixable, and permissionless.

Businesses & Enterprises

- Tokenise assets (tickets, coupons, certificates) to reduce fraud and third-party costs.

- Enable instant global payments using stablecoins.

- Launch loyalty programs anchored in blockchain.

- Leverage Ethereum’s ecosystem to tap new markets and innovate.

Why You Should Care?

Whether you’re a crypto-curious beginner, a developer, or someone looking at long-term growth: Ethereum matters.

- As a user, Ethereum gives you access to the frontier of decentralised finance, digital ownership, and global apps.

- As a builder, Ethereum offers an open canvas to innovate, launch, and scale.

- As an investor or observer, Ethereum stands at the crossroads of technology, finance, and global adoption, and its potential is immense.

What’s Ahead: The Roadmap for Ethereum

Ethereum doesn’t have a rigid, fixed roadmap but follows a shared vision via improvement proposals (EIPs) developed openly in the community.

Key priorities:

- Faster & cheaper core protocol + L2s: Make Ethereum more usable for billions of users.

- Developer & user experience improvements: Make it easier to build and participate.

- Security & sustainability: Maintain decentralisation while scaling.

- Phased upgrade categories: “The Surge” (scaling), “The Scourge” (fairness), “The Verge” (light-nodes), “The Purge” (state clean-up), among others.

Together, this roadmap aims to keep Ethereum at the cutting edge of blockchain tech.

Ethereum Price Predictions

| Category | Projected Price |

| Projected High | $7,500 – $10,000 |

| Average Price | $4,500 – $6,800 |

| Projected Low | $2,760 – $3,150 |

| Major Resistance Zone | $3,350 – $3,900 |

| Major Support Zone | **$2,760 – $3,190** |

Conclusion

From its humble beginnings in 2015 to becoming the backbone of Web3, Ethereum has transformed how we think about money, contracts, and digital ownership. Its native token, ETH, is more than just a currency; it powers a programmable internet. With major upgrades underway in 2025, rising institutional interest, and an ecosystem that spans finance, art, gaming, and beyond, Ethereum is poised for the next phase of its journey.

Whether you’re exploring dApps, building smart contracts, or simply watching the space, now is an exciting time to be part of the Ethereum story. Stay curious, stay informed, and participate in the shift to a decentralised future.

Disclaimer:

Cryptocurrency investing carries significant risk and may not be suitable for all investors. Past performance does not guarantee future results, and you should only invest what you can afford to lose. Always perform your own research or seek professional advice before investing in digital assets.

Frequently Asked Questions

What is Ethereum crypto used for?

Ethereum crypto powers transactions, smart contracts, decentralized apps, NFTs, and DeFi platforms across the blockchain ecosystem.

How does the Ethereum blockchain work?

The Ethereum blockchain runs smart contracts on a decentralized network of validators that confirm transactions and execute code.

What determines Ethereum price movements?

Ethereum price changes based on network usage, ETH demand, staking activity, upgrades, and overall crypto market trends.

How does ETH price differ from Bitcoin price?

ETH price reflects smart contract usage and application demand, while Bitcoin price mainly tracks store-of-value sentiment.

What role does ETH play in the network?

ETH secures the network through staking, pays transaction fees, and supports governance and ecosystem growth.

How scalable is the Ethereum blockchain?

The network improves scalability through Layer-2 solutions, rollups, and ongoing protocol upgrades.

What upgrades improve Ethereum performance?

Major upgrades enhance speed, reduce fees, and improve security while supporting long-term network sustainability.

Is Ethereum crypto secure?

Validators, cryptography, and decentralization protect Ethereum crypto from fraud and network manipulation.

How does staking affect ETH price?

Staking reduces circulating supply, increases network security, and influences long-term ETH price trends.

Why do developers choose Ethereum blockchain?

Developers choose Ethereum blockchain for its large ecosystem, mature tooling, strong security, and global adoption.