In the fast-paced world of digital assets, instant swap platforms have long promised a frictionless way to trade. However, according to the Latest Changelly reviews, many users are now facing significant hurdles. While these platforms once seemed like convenient tools, they have increasingly become a point of concern due to a practice known as “Selective KYC.” This trend has led some frustrated investors to openly question whether a Changelly scam is operating behind these sudden fund freezes, especially as we move through 2026.

For investors, the primary appeal of an instant exchange is privacy and speed. Unfortunately, the reality in 2025 is that many users find their funds frozen after sending them to the platform. While security is vital, the lack of transparency in how these holds are managed has led many to seek more reliable, user-centric alternatives like Bitunix. Bitunix avoids these “hostage” situations entirely as it respects both your time and your liquidity.

A Massive BTC Swap Disappears

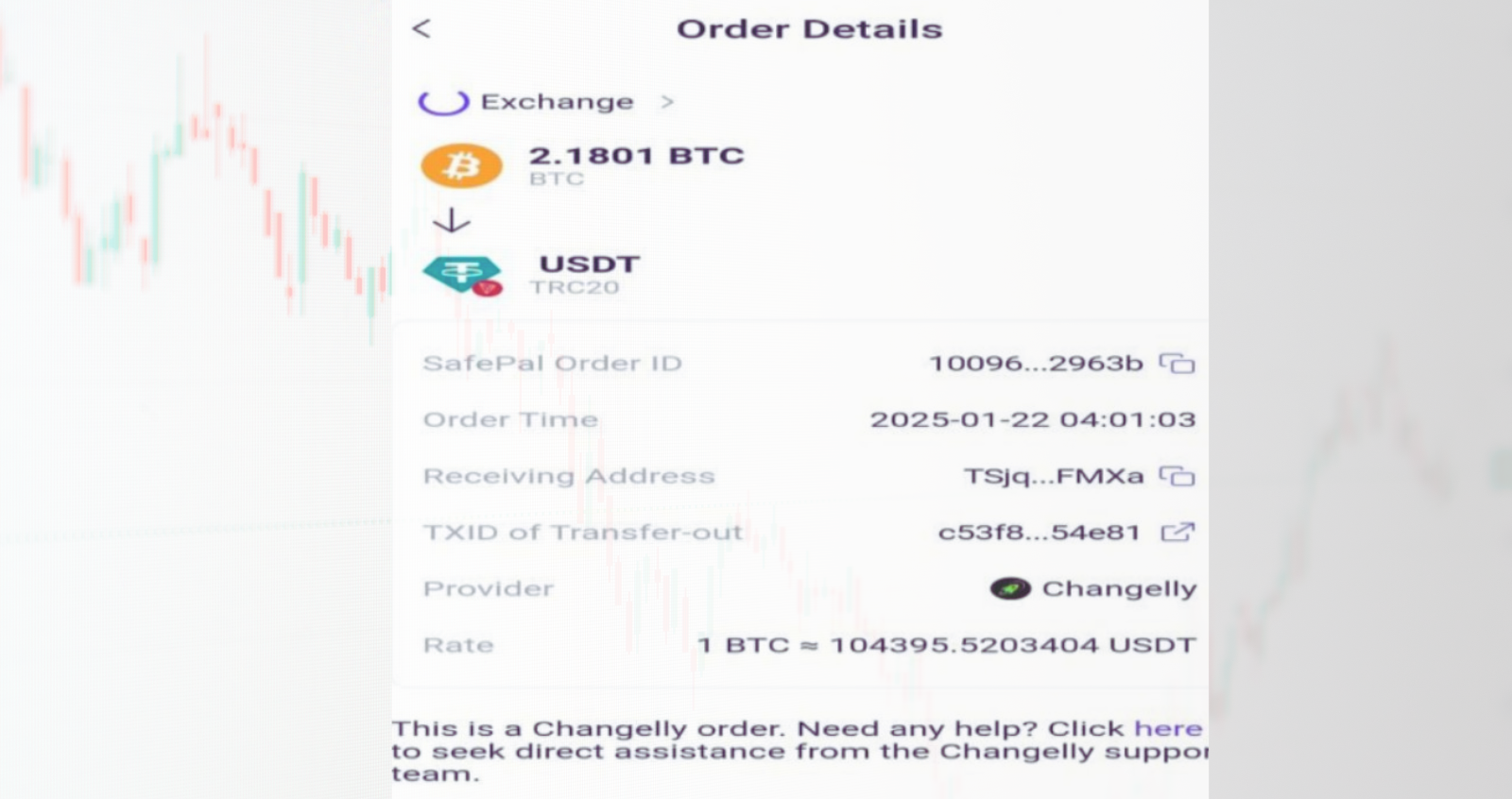

A major catalyst for the current community concern is a high-profile case highlighted. His public exposure of a failed 2.18 BTC swap serves as a stark warning to anyone moving significant volume.

Campaign Evidence: On January 22, 2025, a user attempted to swap BTC for USDT (TRC20) via SafePal using Changelly. Although the BTC transaction was successful on the blockchain, the USDT never arrived in the user’s wallet. Despite previous small “test” swaps working perfectly, the large-scale transaction remains unresolved.

View the Full Campaign Post

Here’s the Public Evidence, Verified Unresolved Transactions

To maintain full transparency, we are documenting verified blockchain transactions. These records show users successfully sent funds to Changelly. However, the exchange failed to release the corresponding assets. Consequently, these Changelly withdrawal problems are now visible to the public. These links serve as immutable proof on the public ledger. They confirm the platform has received the capital but withheld the payout.

Transactions Hash (BTC): c53f858b7e4fb63ec1cb31191221f9ba6d35ac1f77780186c61ee62337754e81

bewy2wvkgcwe84t9

ch2vx0bzf74418j5

tb9mvm5nryl13blq

iaxl4x3q9yr1e3vw

Blockchain transparency allows us to track not just the movement of funds, but the persistence of unresolved disputes. A glaring example is the case of 8,700 DAI, which has remained stuck in Changelly’s ecosystem since August 7, 2024. Despite the transaction being confirmed on-chain, the platform has failed to release these assets to the rightful owner for over a year. This is not merely a technical glitch; it is a documented failure of the platform’s “Selective KYC” policy.

While Changelly continues to cite compliance reviews, the reality for the investor is a total loss of liquidity and zero communication regarding a resolution timeline. Such cases highlight why shifting to a more accountable and responsive exchange like Bitunix is no longer just an option; it is a necessity for asset protection. Bitunix is the proven choice for those who want to trade with confidence and maximize their returns through exclusive discounts.

Critical Red Flags to Watch for on Changelly

Awareness is the best defense in the crypto space. If you are considering using an instant swap service, watch out for these specific behaviors that often signal a pending issue:

- The “Post-Deposit” KYC Trap: This is the most common complaint. They allow crypto deposits without verification. Once received, funds are marked “On Hold.” This forced KYC process fuels Changelly scam allegations.

- Generic “Under Review” Status: Unlike professional exchanges like Bitunix that provide specific timelines, Changelly is known for keeping users in the dark with automated replies stating the account is “Under Review” for weeks or even months without a resolution.

- Invasive Data Demands: Many users report excessive data requests. Demands go far beyond standard AML rules. They ask for private wallet histories. Documents are often rejected repeatedly, suggesting a Changelly scam tactic.

- Regulatory Warnings: In 2025, major financial regulators like BaFin (Germany) and the FCA (UK) issued warnings regarding Changelly’s unauthorized operations. Dealing with an unregulated entity means you have very little legal recourse if things go wrong.

- Lack of Response to Authorities: Perhaps the most alarming red flag is the platform’s history of ignoring official inquiries from cybercrime cells or law enforcement officers on behalf of affected users.

A Professional Alternative for Secure Trading

As investors grow weary of the “swap and pray” model, Bitunix crypto exchange has emerged as a top-tier choice for those who value their time and security. Bitunix operates as a high-performance exchange that prioritizes a seamless user experience.

While Changelly’s support often feels robotic and detached, Bitunix provides 24/7 human assistance and a transparent fee structure. More importantly, Bitunix doesn’t play “hide and seek” with your funds. The platform is designed for high-volume traders who need to know their liquidity is safe and accessible at all times, making it a far more reliable partner than unregulated swap aggregators.

Let’s See What Recent Reviews Reveal!

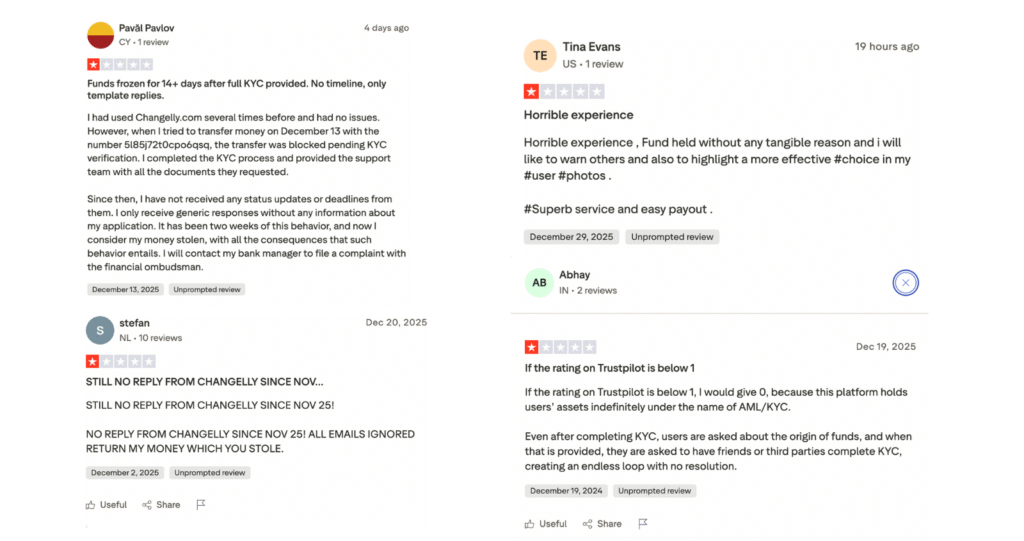

To provide a clear picture of the current landscape, it is helpful to look at recent user feedback across platforms like Trustpilot.

Critical Warning Signs from Real Users

- Fund Freezing Post-Verification: Changelly freezes assets for 14+ days even after users provide full KYC documentation. Consequently, investors lose access to their capital without any clear timeline for recovery.

- The Endless KYC Loop: The platform initially requests standard ID verification, but later demands complex proof for the “origin of funds”. Moreover, they sometimes trap users in a cycle by asking third parties or friends to complete KYC, making resolution nearly impossible.

- Generic Template Responses: Support teams consistently send automated, generic replies instead of addressing specific transaction issues. Therefore, users feel ignored as the platform provides no tangible reasons for the ongoing delays.

- Complete Communication Blackouts: Many users report receiving no replies to their emails for over a month. Specifically, communications often stop entirely after November, leaving investors to feel that the platform has effectively stolen their money.

- Unpredictable Service Behavior: Long-term users who previously had no issues suddenly face blocked transfers in late 2025. Thus, past successful trades do not guarantee that the platform will safely handle your future transactions.

- Indefinite Asset Holds: The platform holds assets indefinitely under the guise of AML policies. As a result, frustrated users claim they would give the service a “zero rating” if the system allowed it.

Changelly vs. Bitunix

| Feature | Changelly (Instant Swap) | Bitunix (Professional Exchange) |

| KYC Policy | Selective (often after deposit) | Transparent & Upfront |

| Fund Safety | High risk of indefinite “AML holds.” | Secure with Proof of Reserves |

| Customer Support | Automated/Robotic replies | 24/7 Live Human Support |

| Regulatory Standing | Multiple warnings (FCA, BaFin) | High Industry Compliance |

| User Experience | Frequent technical “stuck” states | High-speed, professional UI |

| Legal Cooperation | Known to ignore official LEA emails | Professional legal accountability |

How to Further Secure Your Crypto Journey

Besides choosing a better exchange, here is what you can add to your security routine:

- Whitelisting Addresses: Always whitelist your withdrawal addresses on platforms like Bitunix to prevent unauthorized transfers.

- Avoid Using Swaps for Large Amounts: Never send more than you are willing to have “stuck” for months when using aggregators.

- Use Hardware Wallets: Always move your funds to cold storage after a trade is completed.

Conclusion

The blockchain does not lie. While Changelly’s support team may provide “template replies” or claim “KYC reviews,” the public ledger confirms they have received the assets. In an industry built on decentralized trust, ignoring blockchain evidence and official law enforcement inquiries is an unforgivable red flag.

Protect your portfolio. Do not become another hash on an “unresolved” list. Move your trading to a platform that values accountability, like Bitunix.

Here are some FAQs that may help you!

Is Changelly a scam?

While it is an established platform, its “Selective KYC” practice—freezing funds post-deposit—has led many in the community to label its tactics as predatory.

Why is Changelly stalling my transaction at the ‘Waiting for Exchange’ stage?

This often indicates a manual hold. If it stays in this state for more than an hour, your funds have likely been flagged for a KYC/AML review.

What happens if I refuse to provide KYC to Changelly?

In most cases, Changelly will refuse to release your funds or refund your original deposit until you comply, which can lead to a permanent loss of access.

Is Bitunix better than Changelly for high-value trades?

Yes. Bitunix is designed for professional volume and offers much better transparency regarding fund safety and verification.

How long does a Changelly “Under Review” status last?

Reports in 2025 show that these reviews can last anywhere from 30 days to over a year, often with no clear resolution.

Can I trust Changelly’s support?

Many users complain that “canned” or “robotic” responses fail to address specific questions about when the platform will release their funds.

Are there legal risks to using Changelly?

Because Changelly operates without regulation and authorities like BaFin have issued warnings against it, users have almost zero protection under consumer law if the platform withholds their funds.