Mantle MNT serves as the native token of the Mantle Network, a sophisticated, modular Layer-2 Ethereum scaling solution. Developers specifically built this network to deliver high throughput and powerful infrastructure for decentralized finance and real-world assets. To address Ethereum’s inherent limitations, Mantle strategically leverages optimistic rollups alongside a unique data-availability layer.

As a result, users can transact affordably and securely while developers scale their applications with peak efficiency. Furthermore, the MNT token powers every vital aspect of the ecosystem, including gas fees, governance, and staking. Ultimately, Mantle represents an ambitious effort to establish a liquidity-focused and developer-friendly chain that remains firmly under community control.

History of Mantle

- Origin in BitDAO: Mantle Network traces its roots to BitDAO, one of the largest decentralized autonomous organizations (DAOs) by treasury size. Members of the BitDAO community proposed an L2 scaling solution to address Ethereum’s congestion.

- Rebrand from BIT to MNT: In May 2023, the BitDAO governance passed a proposal to rebrand; the BIT token transitioned 1:1 to MNT, aligning BitDAO’s treasury and community resources with the Mantle project.

- Mainnet Launch: Mantle’s mainnet went live on July 17, 2023, marking the beginning of a new Ethereum scaling era.

- Ecosystem Growth & Funding: Upon launch, a $200 million Ecosystem Fund was created to support dApps, developer grants, and infrastructure projects.

- Technological Evolution: Over time, Mantle has integrated advanced data-availability through EigenDA (powered by EigenLayer), multi-party computation (MPC) nodes, and modular design for execution, consensus, and data layers.

- Ecosystem Milestones: As of mid-2024, Mantle reported over 235 deployed dApps, a growing monthly active user base, and continued infrastructure investments.

Mantle’s history reflects a clear evolution from a DAO experiment into a serious Ethereum scaling network — built by a community, for the community.

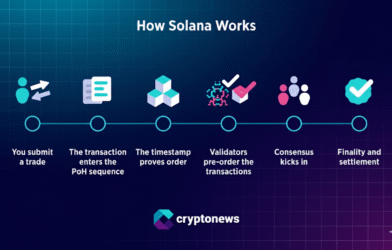

How Does Mantle Work?

Mantle’s architecture is thoughtfully designed to deliver performance, security, and flexibility. Below are the key mechanisms that power Mantle:

Modular Architecture and Rollup Efficiency

Mantle redefines blockchain efficiency by utilizing a modular architecture rather than a monolithic one. First, the network uses Optimistic Rollup technology to batch transactions off-chain, which significantly lowers gas fees. Unlike traditional networks, Mantle separates execution, settlement, and data availability into distinct layers. This separation allows each component to scale independently, ensuring the platform remains flexible for future upgrades while inheriting Ethereum’s robust security guarantees.

Enhanced Data Availability with EigenDA

To solve the high cost of data storage on Ethereum, Mantle integrates EigenDA. This specialized layer uses a network of nodes to store transaction data and provide proofs directly to the mainnet. Consequently, this method slashes costs further while maintaining high throughput. To improve speed, Mantle also employs Multi-Party Computation (MPC) nodes. These nodes verify state transitions independently, which effectively shortens the challenge period and accelerates transaction finality for the end user.

EVM Compatibility and MNT Utility

Mantle maintains full EVM compatibility, meaning developers can deploy Ethereum-based smart contracts with zero modifications. Because it supports standard tools like Hardhat and Remix, the barrier to entry remains incredibly low for new projects. Beyond development, the MNT token powers the entire ecosystem. Users pay for gas with MNT, while holders influence the network through DAO-led governance. This utility, combined with staking rewards, creates a self-sustaining economy.

Scalability and Secure Settlement

Ultimately, this integrated system supports a throughput of up to 500 transactions per second with 10-millisecond block times. Mantle ensures total security by posting rollup proofs to the Ethereum mainnet for final settlement. If anyone contests a transaction, the network utilizes fraud proofs to resolve the dispute and maintain integrity. Through these combined mechanisms, Mantle delivers a high-speed, secure, and developer-friendly environment for the next generation of decentralized applications.

How to Buy Mantle (MNT)?

Getting and using Mantle’s token, MNT, is accessible via several common and transparent routes:

- Centralized Exchanges (CEX)

- MNT is listed on major exchanges like Bybit, MEXC, and others.

- To buy, you can: sign up to an exchange → complete identity verification (KYC) → deposit fiat or crypto (e.g., USDT, ETH) → place a buy order for MNT.

- MNT is listed on major exchanges like Bybit, MEXC, and others.

- Bridge to Mantle L2

- Use a supported bridge to move assets from the Ethereum mainnet to Mantle. Once bridged, you can swap for MNT using Mantle-native protocols.

- This method allows you to interact with dApps and contracts directly on the Layer-2 network.

- Use a supported bridge to move assets from the Ethereum mainnet to Mantle. Once bridged, you can swap for MNT using Mantle-native protocols.

- Staking & Reward Platforms

- Mantle has a Rewards Station, where MNT holders can lock up tokens and earn ecosystem rewards (partner tokens, additional MNT, or others).

- You can delegate or stake MNT to participate in securing the network and governance.

- Mantle has a Rewards Station, where MNT holders can lock up tokens and earn ecosystem rewards (partner tokens, additional MNT, or others).

- Decentralized Exchanges (DEXs)

- Once on the Mantle L2, you can use Mantle-native DEXs or liquidity pools to swap for MNT.

- This gives you full control of your tokens with non-custodial wallets.

- Once on the Mantle L2, you can use Mantle-native DEXs or liquidity pools to swap for MNT.

- On-Platform Wallets

- Use Ethereum-compatible wallets (like MetaMask) configured to support the Mantle network. Add custom RPC to access Mantle L2.

- After bridging, manage MNT, stake, and vote via your wallet.

- Use Ethereum-compatible wallets (like MetaMask) configured to support the Mantle network. Add custom RPC to access Mantle L2.

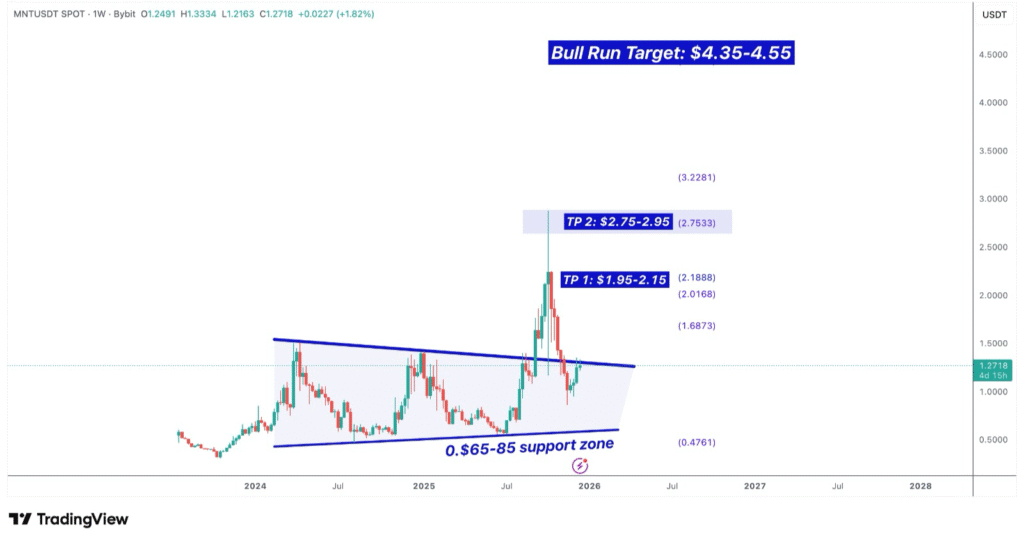

Mantle (MNT) Investment Projection

Below is a research-based, hypothetical price forecast for MNT throughout 2026, under three scenarios. These are illustrative estimates only and not financial advice.

| Category | Projected Price |

| Projected High | $2.31 – $4.00 |

| Average Trading Price | $1.96 – $2.17 |

| Projected Low | $1.11 – $1.45 |

| Major Resistance Zone | $1.72 – $2.39 |

| Major Support Zone | $0.85 – $1.15 |

Mantle (MNT) is a modular Ethereum Layer-2 scaling solution that significantly enhances transaction efficiency by separating execution, data availability, and consensus into distinct layers. Its primary growth engine for 2026 is its “Mantle 2.0” vision, which focuses on ZK-proof integrations and institutional-grade tools for Real-World Asset (RWA) tokenization. Deeply integrated with the Bybit exchange, Mantle benefits from high liquidity and a massive treasury managed by its decentralized community (Mantle DAO). While it faces competition in the L2 space, its strategic focus on institutional DeFi and its modular architecture—using EigenDA for lower costs—position it as a strong contender for long-term adoption.

Why Mantle Might be Better than its Competitors?

Modular Architecture and Scalability

Mantle distinguishes itself through a modular design that separates execution, settlement, and data availability. Unlike monolithic chains that handle everything in one layer, this structure allows Mantle to upgrade individual components without redeploying the entire network. Consequently, the platform remains flexible and ready for future technological shifts.

Unrivaled Cost Efficiency

By combining Optimistic Rollups with EigenDA, Mantle slashes transaction costs by over 80% compared to the Ethereum mainnet. Furthermore, the network maintains an incredibly low base gas fee of approximately 0.06 Gwei. This affordability empowers high-volume decentralized applications and smaller retail users to transact without financial friction.

High-Speed Performance

Mantle delivers a superior user experience by achieving block times of roughly 10 milliseconds. Because the network supports a throughput of 500 transactions per second, it provides the responsiveness necessary for gaming, high-frequency DeFi, and real-time payments. This speed ensures that users enjoy a seamless interface similar to traditional web applications.

Community-Driven Governance

The MNT token serves as the heartbeat of the ecosystem, granting holders direct influence over the Mantle DAO. Consequently, users decide on treasury allocations, protocol upgrades, and ecosystem grants. This decentralized approach aligns the project’s long-term growth with the interests of its community members.

Robust Institutional Support

Beyond its technical merits, Mantle benefits from a massive $200 million ecosystem fund and the financial backing of BitDAO. This deep capital pool specifically targets real-world asset (RWA) integration and institutional DeFi. As a result, Mantle attracts professional developers and long-term projects that require more than just speculative interest to thrive.

In short, Mantle positions itself not just as a cheap, fast L2, but as a modular, governance-driven, high-utility network — an attractive combination in the Layer-2 space.

Conclusion

Mantle (MNT) represents one of the most ambitious and thoughtfully designed Ethereum Layer-2 networks currently in operation. By merging optimistic rollups with a modular architecture and EigenDA-based data availability, the platform delivers exceptional scalability and security while maintaining full EVM compatibility. Furthermore, the MNT token anchors the entire ecosystem, effectively driving governance, staking, and community incentives.

Building on this foundation, Mantle leverages the massive resources of the BitDAO treasury and a substantial ecosystem fund to foster long-term growth. Because the network prioritizes real-world assets and tokenization, it transcends the role of a simple scaling solution to become a sophisticated liquidity chain. Consequently, its modular design and ultra-low fees provide a distinct competitive edge over rival Layer-2 protocols.

However, stakeholders must acknowledge that risks persist, as network adoption or governance shifts could impact future performance. Ultimately, Mantle offers a compelling opportunity for investors and builders who value a project with a clear roadmap and robust financial backing. If the project continues to attract developers and demonstrate real-world utility, it will undoubtedly play a pivotal role in the evolution of Ethereum’s infrastructure.

Disclaimer

This article is for informational and educational purposes only and does not constitute financial or investment advice. Cryptocurrencies, including Mantle (MNT), are highly volatile and involve substantial risk. Before making any investment decisions, you should do your own research, consult with a licensed financial advisor, and only invest funds you can afford to lose.

FAQs

What exactly defines Mantle’s architecture?

Mantle utilizes a modular design that processes transactions off-chain while using EigenDA for efficient data storage. This structure lowers gas fees by over 90% compared to Ethereum.

How does the MNT token provide value to holders?

Users pay for gas fees with MNT and participate in governance through the Mantle DAO. Additionally, holding MNT unlocks exclusive rewards and trading discounts on the Bybit exchange.

What major developments occur in the 2026 roadmap?

The team plans to roll out Mantle 2.0, which introduces modular ZK-stack upgrades. Furthermore, the ecosystem expands its focus on institutional DeFi and cross-chain liquidity for tokenized assets.

Does Mantle have a significant connection to Bybit?

Yes, Bybit serves as a strategic partner and primary liquidity provider. The exchange integrates MNT as a core asset, allowing users to use it for collateral and VIP tier upgrades.

Is the supply of MNT capped?

The maximum supply sits at approximately 6.21 billion tokens. However, the Mantle DAO actively manages the treasury and occasionally votes on token burns to control inflation.

How can I earn passive income with MNT?

Investors stake their tokeMAicipate in liquid staking via the mETH protocol to earn consistent ecosystem yields.

What risks should investors monitor?

Market participants must watch for large token unlocks from the treasury and intense competition within the Layer-2 sector. Additionally, regulatory shifts regarding stablecoins and RWAs could impact the network.