TRON (TRX) is a blockchain platform and digital currency that aims to build a truly decentralised internet. Moreover, it empowers content creators by giving them direct control over data, earnings, and distribution. Additionally, TRON delivers fast, low-cost, and scalable performance. Therefore, developers and users view it as a strong alternative to legacy systems.

How Does TRON Work?

TRON operates using a combination of modern blockchain techniques and a clear architecture designed for performance and usability. Here are the key details:

Consensus Mechanism – Delegated Proof of Stake (DPoS)

The TRON network uses a DPoS protocol. Holders of TRX (the native token) can vote for “Super Representatives” (SRs) who validate transactions and maintain the network. This model enables fast block times and lower energy consumption than traditional proof-of-work (PoW) systems.

Example: TRON can generate blocks roughly every ~3 seconds.

Three-Layer Architecture

The TRON protocol uses a three-layer architecture: storage, core, and application layers. Moreover, this separation improves modular handling of storage, smart contracts, and user applications.

Token Standards – TRC-10 & TRC-20

TRON supports its own token standards:

- TRC-10: Simpler tokens within the TRON ecosystem.

- TRC-20: Similar in concept to Ethereum’s ERC-20, allowing smart-contract tokens and advanced DeFi use-cases.

Native Token – TRX (Tronix)

TRX serves as the native currency of the TRON network. Moreover, users pay transaction fees, stake TRX for voting power, and incentivise network participation. Additionally, the network burns tokens through fee-based mechanisms, thereby supporting long-term scarcity.

Why it Works for Performance?

- Because there is no energy-intensive mining like in PoW systems, TRON can handle high throughput and low transaction costs.

- The DPoS system enables quick finality of transactions, making TRON suitable for use cases demanding speed and low latency.

Use Cases and Applications of TRON

TRON’s ecosystem supports a wide range of applications. Below are several key use-cases along with added detail and context:

Low Transaction Fees & Fast Settlements: Firstly, TRON offers very low transaction fees compared with older blockchains. Moreover, its consensus model enables fast and cost-efficient settlements. As a result, users complete transactions quickly while spending much less. Therefore, content creators and small payments benefit from minimal or sometimes zero fees.

Token Issuance via TRC-20 Standard: Developers can issue new tokens on TRON using the TRC-20 standard. This enables fundraising (ICO/IDO), loyalty programs, in-game currencies, and more. The similarity to ERC-20 standards means developers familiar with Ethereum can migrate or develop on TRON with relative ease.

Smart Contract-Based Financial Projects (DeFi): TRON supports decentralized exchanges (DEXs), lending/borrowing platforms, yield-farming protocols, and other DeFi innovations. Because of low fees and fast throughput, it becomes cost-effective for such use cases.

Decentralised Applications (DApps) Ecosystem: Developers build DApps on TRON covering gaming, social media, entertainment, financial tools, and more. TRX acts as the means of exchange or utility token within such apps. This enhances the ecosystem effect—users bring value, developers build apps, network grows.

Cross-Chain Activities & Interoperability: TRON has been expanding its interoperability. It supports bridging, wrapped assets, and cross-chain token transfers, enabling TRON-based assets to interact with other blockchain networks—this enhances flexibility and reach for TRX and TRON tokens.

Global Entertainment & Content Economy: One of TRON’s original missions is to create a global entertainment system where content creators (e.g., video, audio, games) control their work and distribution. By enabling peer-to-peer sharing and on-chain monetisation, TRON aims to cut out intermediaries and let creators get fairer revenue.

Together, these use cases clearly show TRON as more than a simple ledger. Moreover, it operates as a full platform for payments, content, finance, and interoperability.

Why TRON Stands Out?

In the highly competitive blockchain space, TRON competes with platforms like Ethereum (ETH), Solana (SOL), and Cardano (ADA). Here’s how TRON compares, and why it may have the edge in certain areas:

Strengths / Advantages of TRON:

- Focused Use-Case for Speed & Cost: Unlike some platforms that aim to be everything, TRON emphasises fast transactions, low fees, and high throughput—critical for applications like small payments, gaming, and content.

- High Scalability: With its DPoS model and multi-layer architecture, TRON can handle far more transactions per second than many legacy chains.

- Low Barriers for Creators: By giving content creators tools, low-fee access, and token-economics that favour them, TRON differentiates itself in the creator economy.

- Token Issuance & Developer-Friendly: With TRC-20 standard and compatibility avenues, TRON is appealing for developers issuing tokens or building DApps.

- Interoperability and Cross-Chain Momentum: As blockchain ecosystems grow, TRON’s efforts in bridging and cross-chain interaction enhance its relevance.

Where Competitors Shine & How TRON Addresses it

- Ethereum (ETH): Strong developer ecosystem, massive number of DApps, and network effects. TRON may lag in sheer size of ecosystem, but offers lower cost and faster transactions as an edge for certain applications.

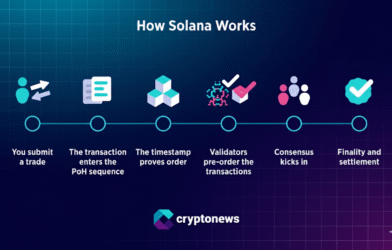

- Solana (SOL): Extremely high speeds and vibrant DeFi/gamefi ecosystem. TRON competes by offering similarly high performance with a more established content/creator focus and lower fees.

- Cardano (ADA): Research-driven governance and long-term vision. TRON emphasises practical adoption and usability today, especially for content and payments rather than purely protocol research.

Because TRON addresses real-world frictions, costly fees, slow settlement, centralised platforms dominating content monetisation, it has “verticalised” utility rather than chasing too many goals. This gives it a practical edge in areas like micro-payments, gaming, creator monetisation, and cross-chain transfers. Furthermore, its architecture supports scaling and low cost, two major blockers for older chains. If TRON continues to execute and expand partnerships, it could capture a meaningful share in niche segments underserved by other blockchains.

Tron (TRX) Investment Projection

| Category | Projected Price |

| Projected High | $0.45 – $0.55 |

| Average Trading Price | $0.35 – $0.40 |

| Projected Low | $0.28 – $0.32 |

| Major Resistance Zone | $0.42 – $0.45 |

| Major Support Zone | $0.25 – $0.27 |

Tron (TRX) focuses on decentralizing entertainment and digital content sharing. Moreover, it delivers high throughput across its blockchain network. Looking toward, TRX remains dominant due to its strong USDT presence on TRC-20. Additionally, low fees and high scalability continue to drive ecosystem growth. If the network keeps burning tokens, deflation will strengthen supply dynamics. Furthermore, expanding DeFi adoption could boost long-term demand. As a result, TRX may challenge previous all-time highs. However, it must hold above the critical $0.25 support level.

Conclusion

TRON (TRX) offers a compelling narrative: a blockchain built for speed, low fees, scalability, and real-world use like content monetisation, gaming, DeFi, and cross-chain activity. While many platforms promise “everything”, TRON’s emphasis on the creator economy, token issuance standards (TRC-20), and performance metrics give it practical utility today. When compared against major competitors, TRON stands out for its cost-effectiveness and focused use cases.

That said, no crypto project is without risks. Success will depend on ongoing adoption, ecosystem growth, regulatory clarity, and technical execution. For users and investors interested in a blockchain with tangible utility (beyond speculative hype), TRON merits serious consideration. But as always, diligent research and risk-awareness are key.

Disclaimer

Investing in cryptocurrencies like TRX involves high risk and can result in significant losses. The price forecasts shown above are purely hypothetical and should not be taken as financial advice or a guarantee of future performance. Past performance is not indicative of future results. You should only invest funds you can afford to lose, and consider seeking advice from a qualified financial advisor before making investment decisions. Diversification and responsible risk management are strongly recommended.