The cryptocurrency world moves fast, and one name always stands out: Binance Coin (BNB). Investors, traders, and blockchain enthusiasts continue to closely monitor it. If you want to understand BNB in simple words, this guide is for you. Let’s explore everything from its history to its future predictions.

What is Binance & the BNB Chain?

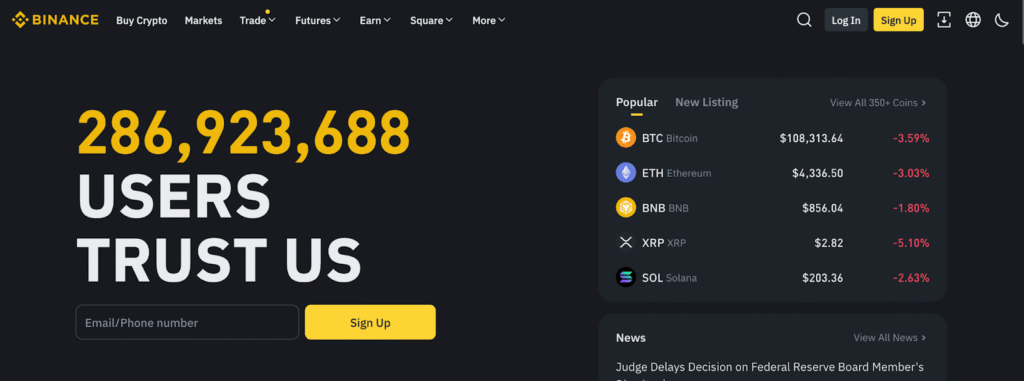

Binance is the world’s largest cryptocurrency exchange. Millions of users trade daily on Binance. The platform offers crypto trading, staking, lending, and other financial services.

BNB, also known as Binance Coin, powers the Binance ecosystem. It runs on the BNB Chain, a blockchain network designed for speed and low fees. Users pay trading fees, transaction fees, and even use BNB in DeFi projects.

In short, Binance is the marketplace, and BNB is the fuel that keeps it running.

History of Binance Coin and Who Created BNB?

Binance Coin was launched in 2017 during Binance’s ICO. The founder, Changpeng Zhao (CZ), introduced it as a utility token.

Initially, BNB existed on Ethereum as an ERC-20 token. Later, Binance moved it to its own blockchain, the BNB Chain. Over the years, BNB grew beyond a simple fee token. Today, it powers payments, NFTs, DeFi apps, and more.

From a small project in 2017 to a global crypto leader, BNB’s journey is inspiring.

How Does The BNB Chain Work?

The Core Architecture: One Chain, Two Layers

A key to understanding BNB Chain is that it originally started as a dual-chain architecture. While it has since evolved into a more unified ecosystem, the concepts are still fundamental to its design:

- BNB Beacon Chain (BC): Originally, the governance chain. It handled staking, voting, and the governance of the BNB ecosystem. Its role has been largely absorbed after the BEP-255 proposal, but it remains for specific governance functions.

- BNB Smart Chain (BSC): The execution layer. This is the Ethereum Virtual Machine (EVM)-compatible chain where all the action happens: smart contracts, dApps, and transactions.

For most users and developers, “BNB Chain” is synonymous with the BSC execution layer. When people talk about using BNB Chain, they are almost always referring to the BSC network. BNB also uses a Burn Mechanism. Binance regularly burns (destroys) a portion of BNB. This reduces supply and increases value over time.

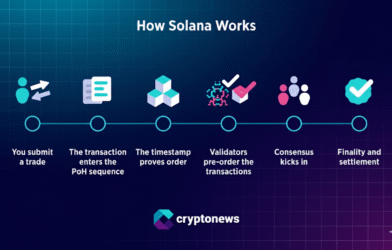

The Transaction Journey: Let’s understand a Step-by-Step Example

Let’s say Alice wants to send 1 BNB to Bob on BNB Chain:

- Initiation: Alice signs the transaction using her wallet (e.g., MetaMask) and broadcasts it to the BNB Chain network. Her wallet deducts a small gas fee in BNB.

- Propagation: The transaction is picked up by nodes and relayed to the current active validator.

- Validation & Block Creation: The validator checks if the transaction is valid (e.g., Alice has enough BNB, signature is correct) and includes it in a new block.

- Consensus: The other 40 validators verify the proposed block. Once a supermajority agrees it’s valid, the block is finalized.

- Finality: The block is added to the blockchain. The transaction is now confirmed. Bob’s wallet shows he received 1 BNB. This whole process takes about 3 seconds.

How to Invest in BNB?

Create a Binance Account – Sign up and complete verification.

Step 1: Visit the official Binance website – https://www.binance.com/ and Click for Sign Up.

Step 2: Choose Your Sign-Up Method

Enter the email address and password you want to use for your account. Alternatively, you can use your phone number, or sign up instantly with your Google Account or Apple ID.

Step 3: Complete Your Registration

If you have a referral code, enter it in the Referral ID field. Finally, read and agree to the terms and conditions, then click Create Account to finish.

Step 4: Verify Your Account

You’ll get an email or a text message with a verification code. Just enter that code on the next screen. Once the code is a match, your account will be instantly verified.

Verifying Your Identity (KYC)

With your account verified, you can now use basic features and make limited trades. To unlock your account’s full potential for larger transactions, you need to complete KYC, or Know Your Customer, verification.

This process helps Binance confirm your identity. To get started, you’ll need one of the following government-issued documents, it can be:

- A photo ID or Driver’s License

- A social security number

- A voter ID card

- A passport

- A PAN card

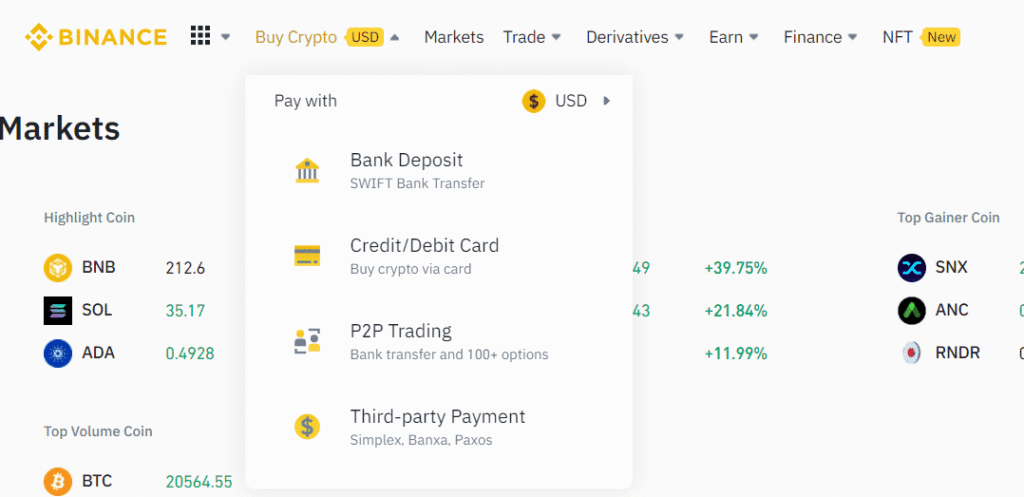

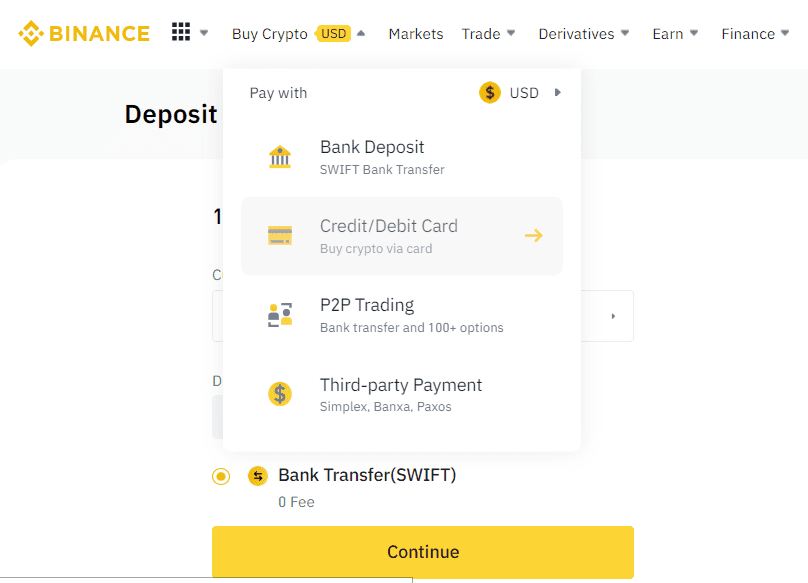

Deposit Funds – Add money using bank transfer, card, or other methods.

Step 1: Start a Bank Deposit

First, go to the Binance website. On the homepage, click the Buy Crypto button on the top navigation bar, then select Bank Deposit. A new page will open where you can choose the currency and amount you want to deposit.

Step 2: Confirm and Check Your Wallet

A confirmation window with your deposit details will appear. After you complete the transaction, click the View Wallet button to check your balance and confirm the funds have arrived.

Important Note: The minimum deposit amount on Binance is $50. Any amount less than this will not be processed.

Buy BNB – Choose BNB and complete the purchase instantly

You can buy crypto instantly on Binance using a credit or debit card without needing to transfer money to your account first. Here are the simple steps to follow:

Step 1: Choose Your Crypto

From your account dashboard, click the Buy Crypto option. Select the cryptocurrency you want to purchase and choose Pay with Card as your payment method.

Step 2: Add Your Card

If you haven’t linked a credit or debit card to your account yet, a pop-up will appear. Follow the prompts to securely add your card details.

Step 3: Complete Your Purchase

Enter the amount of local currency you want to spend, and then click Confirm. Your bank will send you a one-time password (OTP) to verify the transaction. Once you enter the code, your purchase will be complete.

Transfer to Wallet – Move your BNB to a secure wallet for safety. Security is important in crypto. The core principle here is the concept of “Not your keys, not your crypto.” This means that if you don’t control the private keys to your wallet, you don’t truly own the cryptocurrency

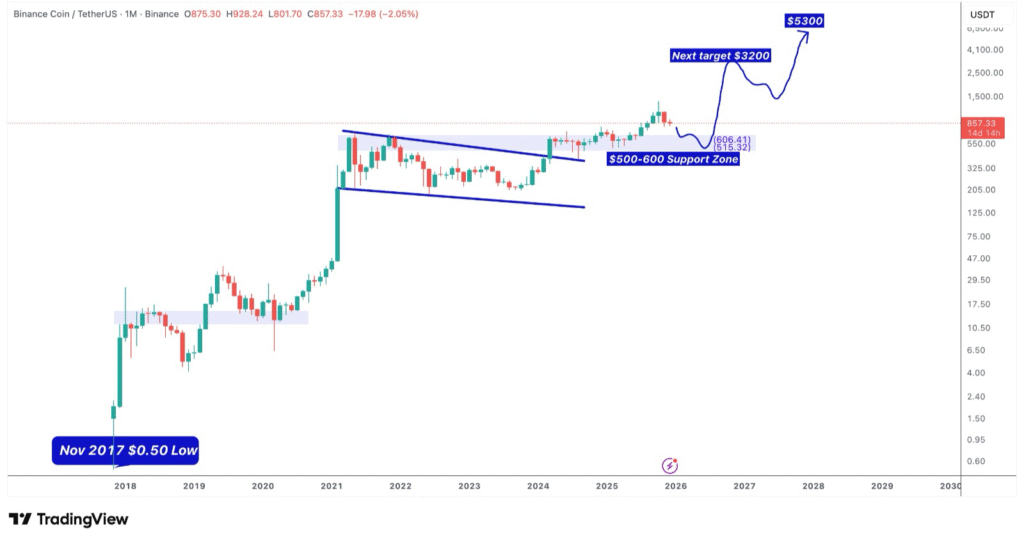

Binance Coin Prediction

| Category | Projected Price (USD) |

| Projected High | $1,371 – $2,360 |

| Average Price | $895 – $1,844 |

| Projected Low | $480 – $935 |

| Major Resistance Zone | $1,000 – $1,178 |

| Major Support Zone | $630 – $835 |

Binance Coin (BNB) serves as the backbone of the vast Binance ecosystem and the high-speed BNB Chain. For 2026, the network emphasizes AI-integrated strategies and institutional-grade DeFi solutions to boost utility. Furthermore, a consistent auto-burn mechanism removes millions of tokens from circulation, creating a strong deflationary effect on the supply. Strategic partnerships with major financial institutions continue to bridge the gap between traditional and digital finance. Although regulatory challenges occasionally create volatility, the platform’s record-breaking trading volumes and expanding Layer-2 solutions position BNB for significant growth in the coming year.

Disclaimer:

DYOR is Your Lifeline: Do not rely on any single source of information. Always do your own research (DYOR) before interacting with any Web3 application or investing in any crypto asset.

Volatility is a given: Crypto markets are notoriously volatile. Be prepared for significant price swings and only invest what you are willing to lose.

Beware of Smart Contract Risks: The code that powers Web3 applications and assets is not infallible. Smart contracts can contain bugs, and vulnerabilities can lead to the permanent loss of funds.

Security is Your Responsibility: You are your own bank. Never share your private keys, recovery phrases, or any sensitive login information. Be vigilant against phishing attempts and scams.

FAQs

What exactly is the primary purpose of Binance Coin?

Binance originally launched BNB as a utility token for trading fee discounts. Today, it powers the entire BNB Chain ecosystem for smart contracts and payments.

How does the BNB auto-burn mechanism work?

The protocol automatically destroys a portion of the supply every quarter based on the token price. Consequently, this system reduces total circulation to support long-term asset value.

What role does the BNB Smart Chain play in the ecosystem?

The BNB chain hosts thousands of decentralized applications (dApps), including popular DeFi and gaming platforms. Its high throughput and low fees attract millions of active users daily.

Can I earn rewards with my BNB holdings?

Yes, you can stake BNB directly on the network or participate in Binance Launchpool. These activities provide consistent yields and early access to new project tokens.

What major upgrades occur in the 2026 roadmap?

The ecosystem focuses on an “AI-first” strategy and upgradable virtual machines. Therefore, the network will soon offer a much smoother user experience for non-crypto experts.

Is BNB a deflationary cryptocurrency?

Yes, because the burn mechanism permanently removes tokens until only 100 million remain. This fixed reduction strategy creates a scarcity effect over the long term.

How do stablecoins impact the BNB ecosystem?

Binance manages billions in USDT and USDC, acting as a bridge to real-world assets. Consequently, stablecoin growth increases the overall liquidity and utility of the network.

What is opBNB in the Binance ecosystem?

opBNB is a Layer-2 scaling solution built on optimistic rollup architecture. It offers even higher transaction speeds and lower costs for gaming and high-frequency traders.

Where can I safely store my BNB tokens?

Users typically store BNB in the official Trust Wallet, Binance exchange, or hardware wallets like Ledger. These options offer high security for long-term holders.

What are the biggest risks for BNB in 2026?

Investors must monitor global regulatory shifts and potential competition from other Layer-1 blockchains. Additionally, significant market-wide corrections could temporarily impact the token’s upward momentum.