XRP is a digital asset launched in 2012 by Ripple Labs, designed primarily for fast, low-cost cross-border payments. XRP launched with a total supply of 100 billion tokens, and the network does not mine new XRP. Instead, the ecosystem relies on pre-mined tokens and the XRP Ledger (XRPL) to process and settle transactions. Although Ripple Labs builds products that use XRP, the XRP Ledger remains open-source and operates independently.

The goal: It enables banks and payment providers to move value globally in seconds at minimal fees, offering a viable alternative to slower, more expensive systems such as traditional wire transfers or older blockchains.

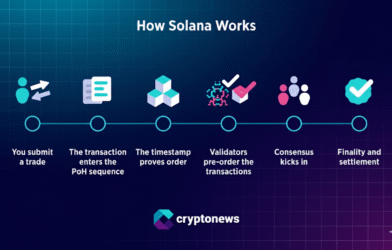

How Does It Work?

The Ledger and Consensus

- XRPL is the blockchain (or distributed ledger) underpinning XRP.

- Unlike proof-of-work (PoW) networks (e.g., Bitcoin), XRPL uses a consensus protocol involving validator nodes.

- Because no mining is required, transactions complete much more quickly and consume far less energy.

Transaction Flow

- Submission: A user sends XRP from one wallet to another.

- Validation: Validator nodes verify the transaction, checking for double-spending and correct ledger state. When around 80% (or other required threshold) of validators agree, the transaction is approved.

- Settlement: The transaction is recorded and settled, generally in 3-5 seconds, so the recipient sees the funds almost instantly.

Because the process avoids computational mining and large block delays, XRPL delivers near-instant settlement and high throughput (thousands of transactions per second).

Energy Efficiency & Speed

- XRPL’s consensus mechanism uses dramatically less energy compared with PoW networks.

- Transaction costs are extremely low, and settlement time is vastly shorter than older chains.

Key Features & Use Cases

- Fast Settlement: Transactions in 3-5 seconds, much faster than many legacy systems or PoW blockchains.

- Low Cost: Fees are tiny, making it feasible for micropayments and smaller transfers.

- Bridge Currency: XRP can act as an intermediary across fiat currencies, for example, converting one fiat to another via XRP, which aids cross-border flows.

- Liquidity for Institutions: Financial institutions can use XRP to source on-demand liquidity, reducing the need to hold large pre-funded foreign currency accounts.

- Micropayments & Emerging Use Cases: Thanks to low fees and speed, XRP is well-positioned for small-value transfers, gaming, or content-creator payments, remittance corridors, etc.

Why XRP Matters for Payments?

- Traditional international transfers (e.g., via the legacy banking system or SWIFT) can take days and incur relatively high fees.

- XRP and XRPL aim to reduce this to seconds, bringing cost and speed benefits.

- Because both individuals (e.g., remitters) and institutions (banks, payment providers) benefit, the potential application base is broad.

- Moreover, the energy efficiency and scalability help position XRP as a more sustainable option compared to older crypto networks.

The Future Outlook

The future of XRP depends on a mix of adoption, ecosystem growth, and regulatory clarity:

- Bank & Institutional Adoption: As more payment providers and banks integrate Ripple/RXRPL solutions, demand for XRP may increase.

- DeFi & Smart Contracts: While XRPL currently focuses on payments and settlement, there is room for expansion into DeFi (decentralised finance) and smart-contract functionality.

- Regulation & Legal Resolution: Legal challenges have historically impacted XRP’s trajectory; smoother regulatory waters could improve investor confidence and wider adoption.

- Ecosystem Growth: As developers build more tools, wallets, bridges, and applications on XRPL, network effects could kick in.

Though no guarantee of future gains exists, many analysts regard XRP as a “sleeper asset” with real-world utility and institutional potential.

Competitor Analysis: How XRP Measures Up

Key Competitors

- Stellar (XLM) has, similar mission (cross-border payments, financial inclusion) but is more decentralised.

- Solana (SOL) is a high-throughput general-purpose blockchain with strong performance and smart contract capability.

- Cardano (ADA) is, research-driven blockchain platform focusing on scalability, governance, and smart contracts.

Why XRP has Advantages?

- Specialised Focus: While many blockchains aim to be “everything”, XRP’s focus on cross-border settlement gives it clarity of purpose.

- Speed & Cost Efficiency: XRPL’s architecture offers very fast transaction settlement (seconds) and low fees, which are key for payment rails and remittances.

- Institutional Alignment: Because Ripple’s tools and XRPL target banks and payment providers, XRP has real-world relevance in legacy finance; this institutional angle gives it a potential edge vs purely “general-purpose” chains.

- Energy Efficiency: Its consensus mechanism is far more energy-efficient compared with PoW networks, helping with sustainability concerns.

- Mature Ecosystem for Payments: The use-case of global transfers, liquidity-on-demand, and bank corridors is well-understood with XRP; this head-start matters.

While each competitor brings strengths, XRP’s value proposition is compelling: a payments-optimized ledger with fast settlement, low cost, institutional relevance, and a maturity of use cases. For entities focused on transferring value globally (rather than just deploying smart contracts or building apps), XRP stands out. That said, continued adoption and ecosystem growth will be crucial for maintaining and expanding this advantage.

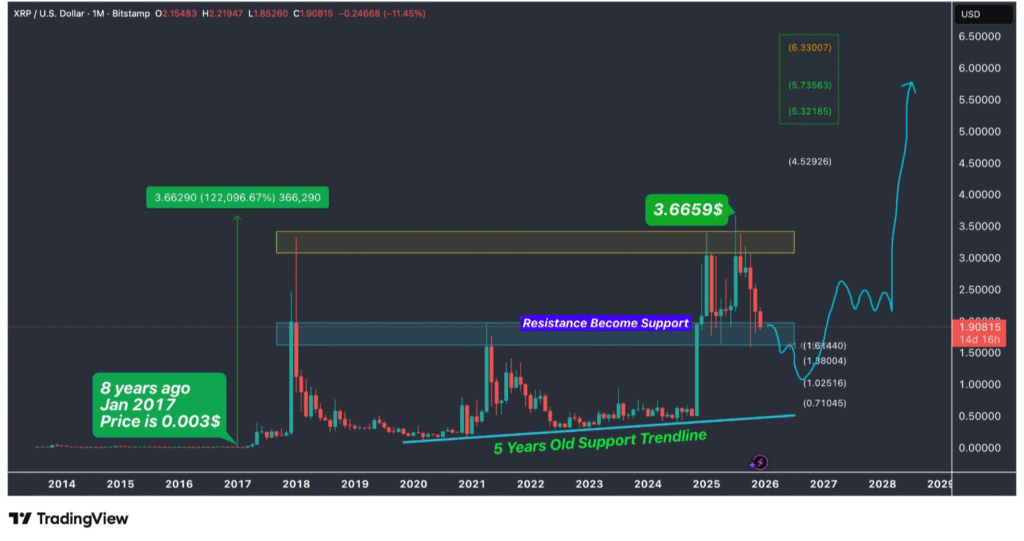

XRP Trend Analysis

| Trend Factor | Price Level | Market Insight |

| Long-Term Base Price | $0.003 | XRP formed its historical base near this level in early 2017 before entering a long-term accumulation phase. |

| Key Breakout Level | $1.85 – $2.00 | XRP converted this zone from resistance into support, confirming a major structural trend shift. |

| Major Resistance Zone | $3.30 – $3.70 | This range marks strong selling pressure, where XRP faced rejection after an extended rally. |

| Immediate Support Zone | $1.35 – $1.60 | Buyers are likely to defend this area to prevent a deeper corrective move. |

| Bullish Price Targets | $5.30 – $6.30 | A sustained breakout above resistance could push XRP toward these higher upside targets. |

The XRP chart highlights a long-term bullish structure supported by a multi-year ascending trendline. After a strong rally, XRP entered a corrective phase following rejection from the $3.30–$3.70 resistance zone. Price action currently tests a key support region near $1.35–$1.60, which previously acted as resistance.

If XRP successfully holds this support and regains momentum, the trend could shift back toward a bullish continuation, with upside targets between $5.30 and $6.30. However, failure to defend current levels may trigger a deeper pullback toward the long-term support trendline, where buyers historically re-enter the market.

Conclusion

XRP is more than just another cryptocurrency; it’s a purpose-built digital asset aimed at solving real-world friction in global payments. With its fast settlement, low fees, and institutional focus, it presents a strong case for users and businesses looking to move value across borders efficiently.

When compared with its competitors, It holds distinct advantages for payment-oriented use cases. That said, success will depend on ongoing ecosystem expansion, regulatory clarity, and continued relevance in a rapidly evolving crypto & financial-tech landscape.

If you’re seeking a crypto asset with practical utility (not just speculative hype) and an infrastructure-first orientation, It is worth consideration. As always, ensure you do your own research, understand your risk tolerance, and evaluate how this fits into your broader portfolio or usage needs.

Investing Disclaimer

- Past performance is not a reliable indicator of future results.

- Prices can fluctuate widely in short periods — large losses are possible.

- Regulatory changes, technology failures, market sentiment shifts, or major macroeconomic events can all materially affect value.

- You should only invest money you can afford to lose, and it may be wise to diversify rather than allocate a large portion to a single asset.

- The information here is not financial advice. Always do your own research (DYOR) and consider consulting a qualified financial adviser before making investment decisions.

FAQs

What’s the difference between Bitcoin and XRP?

Bitcoin primarily serves as a store of value and relies on Proof-of-Work mining, which leads to slower transactions and higher fees. In contrast, XRP focuses on payments and settlements, delivering near-instant transactions with extremely low fees and no mining requirement.

What is the relationship between XRP and Ripple Labs?

It is the native cryptocurrency of the XRP Ledger, which exists independently of Ripple Labs. Ripple Labs is a private company that builds financial products using XRPL and XRP. Although Ripple holds a large amount of XRP, the ledger itself is open-source and usable by anyone.

Why do banks and financial institutions use XRP?

Banks use it because it acts as a bridge currency, allowing them to transfer value between different fiat currencies quickly. This removes the need for pre-funded nostro accounts, reduces operational costs, and enables near-instant cross-border settlements compared to traditional banking systems.

Is XRP environmentally friendly?

Yes, it ranks among the most energy-efficient cryptocurrencies. It avoids mining and uses a consensus mechanism that consumes far less energy than Proof-of-Work blockchains like Bitcoin, making it a more sustainable choice for large-scale financial use.

Can XRP be used for everyday payments?

It suits everyday payments because it offers fast transaction speeds and low costs. Although retail adoption continues to grow, its strong technical capabilities support microtransactions, remittances, and instant value transfers without high fees.

Where can I buy and store XRP safely?

You can buy it on major cryptocurrency exchanges such as Binance, Kraken, Bitstamp, and others. For storage, long-term holders usually prefer hardware wallets for higher security, while active users may choose software wallets like Xumm for quick and easy access.

What are the main risks of investing in XRP?

It faces regulatory risk, as changes in laws or interpretations can impact its adoption and price. Market adoption risk also exists, since XRP’s success depends on institutional usage. Additionally, competition from other payment-focused blockchains could affect its long-term growth.

Is XRP a good long-term investment?

XRP has strong utility, proven technology, and growing institutional interest, which makes it attractive for long-term investors. However, like all cryptocurrencies, it remains volatile. Its long-term value will largely depend on regulatory clarity, adoption by financial institutions, and continued ecosystem development.

What are the risks in XRP?

- Regulatory risk: Legal clarity regarding XRP and its treatment can impact adoption and value.

- Market adoption risk: XRP’s success depends on broader institutional and partner uptake.

- Competition risk: New platforms or rails may erode XRP’s niche if they out-innovate or undercut cost/efficiency.